The 1881 Exposition Universelle in Paris wowed crowds with telephone-transmitted concerts from the Opéra & a demonstration of Edison’s recent improvement of an old idea: the incandescent light bulb. Edison carefully guarded the 1879 patent of the light bulb & only allowed the Compagnie Continentale Edison to diffuse his device in France… some of the original access panels in Paris can occasionally be found [photo above]. Licensing agreements were also given to two German entrepreneurs: Werner von Siemens & Emil Rathenau. Rathenau established the Deutsche Edison Gesellschaft, later reorganized in 1887 as the Allgemeine Elektrizitats-Gesellschaft (AEG). As mentioned in the previous post, the AEG would play an important role in bringing electricity to Buenos Aires.

Development of electricity required a huge amount of investment at the turn of the 19th century. Capital requirements were considered high-risk because electricity was a nascent technology, & the return on any investment could be decades away. Manufactured equipment was expensive, endless kilometers of cables were necessary, & technical know-how remained in the hands of a few. In addition, construction costs in Europe were extraordinary given that hydroelectric power required substantial investment in infrastructure (dam construction, power plants, etc.). Banks rarely felt the risk was worth it.

As the forerunners of energy supply, gas companies in early 20th-century Europe were typically public entities; however, electrical companies were developed & managed by manufacturers of electrical equipment like Pirelli or Brown Boveri. By developing electric companies, they expanded their own markets & created an easy sales outlet for their products. Both the AEG & Siemens followed this market strategy but as the use of electricity became more widespread, so did the difficulties in managing such large & multifaceted companies.

Technological & financial challenges faced by German & Swiss manufacturers led to a solution based on railway company trusts —another similar venture which required large amounts of both capital & equipment. Manufacturers transferred outstanding stock & management responsibilities to holding companies, thereby reducing their own risk, creating the ability to merge management between several different electric companies & attracting new investors. Managing large financial trusts was not their only function; holding companies also planned & supervised the construction of new projects for which they received a commission (on average 7%). The three divisions —electric company, holding company & manufacturer— were so intertwined that their board of directors usually overlapped. One final role was that as the electric company became profitable, holding companies put shares on the market to increase their capital.

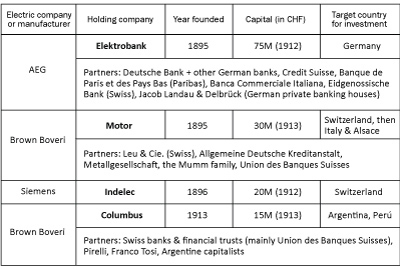

Switzerland offered manufacturers better banking services, so many holding companies were established there. France & Belgium were also attractive options, noted by the creation of the Société Financière de Transports et d’Entreprises Industrielles (SOFINA). Early European success of Brown Boveri with Motor [their Baden headquarters pictured above] inspired them to develop overseas markets for their products. In fact, the Columbus holding company owes its existence to Juan Carosio’s plan to found the CIAE. Click on the table below for specifics:

Interestingly enough, Swiss holding companies never competed with one another. If a new market opened, they would negotiate for complete control or create what Luciano Segreto calls “sub-regional holding companies” —separate trusts using capital from several different holding companies were created, a new name christened & the new holding company began operating as a separate division.

After World War I, the international economic situation proved too difficult for most holding companies to weather. Reorganization & rescue operations caused many holding companies to merge with one another. Swiss banking partners became more directly involved with holding company operations & often placed bank representatives on the board of directors of every holding company. The merger of both Brown Boveri holding companies in 1923 into Motor-Columbus created the largest post-war business of its kind with capital amounting to 60 million Swiss Francs.

During the Interwar period, protectionism in European nations as well as the devaluation of several European currencies forced many Swiss holding companies to expand their horizons to acquire new capital. Motor-Columbus concentrated on securing funds from Switzerland & the Americas… creating the Montreal Foreign Light & Power Co. with Swiss, Canadian & US capital in order to reinvest it partially in Buenos Aires with the construction of the CIAE generator in Puerto Nuevo. But that’s jumping ahead a bit…

CIAE series: Electricity timeline • Precedent & foundation • Swiss holding companies • Architecture 1 2 3 4 • Expansion • Scandal • Fade to black • Building list • Bibliography